And Why Teens Should Start Learning Early

If you’re new to money management, it can be confusing to hear so many terms thrown around — saving, investing, trading. Aren’t they all about making money?

Yes… but they each work very differently.

In this post, I’ll walk you through the basics — using simple examples and clear language — to help you build the right habits from the start.

🐷 1. Saving – The Foundation

Saving means putting your money somewhere safe and easy to access. Most people start by saving in a piggy bank or a bank account.

💬 Saving is like collecting coins in a game and storing them in your backpack. You don’t use them yet — you’re just keeping them safe for later. No risk, no reward.

Why saving is important:

- Helps you build discipline

- Prepares you for emergencies

- Supports short-term goals (like buying a phone or going on a trip)

💡 Saving is storing money safely, like in a bank saving account or piggy bank — no growth, but no danger.

🌱 2. Investing – Making Your Money Grow

Investing means putting your money into something that has the potential to grow over time — like stocks, ETFs, or even real estate. It’s okay, if you have no idea what are these.

💬 Investing is like spending your coins to build a base or upgrade your character over time. You don’t see the results right away, but if you keep upgrading slowly and wisely, your power level increases and pays off in the long run.

With investing:

- Your money can increase in value

- You can earn dividends or interest (extra money pay to you)

- But there’s also a risk that it might go down in value too

Why investing matters:

- It beats inflation (your money keeps up with rising prices)

- It helps you build wealth for big goals (like education, house, or retirement)

- The earlier you start, the more your money can grow (thanks to compounding!)

💡 Trading is trying to make quick gains by buying and selling often — like day trading or flipping crypto, shares and etc.

⚡ 3. Trading – The Fast Lane

ITrading is more like buying and selling quickly to take advantage of short-term price changes. This can happen in stocks, crypto, or options.

💬 Trading is like flipping rare items in the in-game market — you buy something when it’s cheap, hoping to sell it quick when demand goes up. It’s fast, exciting, but risky. If the trend changes, you might lose coins instead of gaining them.

With trading:

- You can make money faster

- But it’s riskier, and easy to lose money without a clear plan

- It requires more time, focus, and emotional control

Why some people trade:

- They enjoy market action

- They want to profit from quick movements

- But most successful traders learn through experience — and even losses

💡 Investing is putting your money into things that grow slowly over time — like stocks, funds, fixed deposits or ETFs.

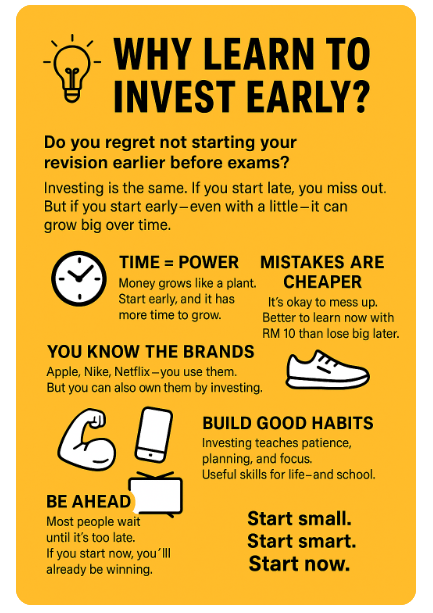

🧠 Why Should Teens Start Early?

Even if you’re not ready to buy stocks or trade yet, this is the best time to learn. Why?

- ✅ You have time — and time is the most powerful tool in investing.

- ✅ You can start with small amounts — even RM10 or $10 saved regularly matters.

- ✅ You’re building smart habits that will stay with you for life.

The goal isn’t just to buy stocks right away. It’s about learning to save, protect your money, and eventually put it where it can grow.

💬 Imagine turning your pocket money into long-term value — not by luck, but by making smart choices early.

🔁 Start Small, Think Big

Whether you’re 14 or 18, starting now — even just by learning — will give you a huge advantage later. Don’t worry about being perfect. The key is to start with basic knowledge, good habits, and a long-term mindset.