This month has been especially volatile, with two major market drops shaking things up.

Market Drops: What Caused Them?

- Early August (around August 1): Market volatility was triggered by concerns over renewed U.S. tariffs and rate policy uncertainty. Historically, August is one of the weakest months for equities, with corrective stretches being common during this period.

- Mid-August (around August 20): The tech-heavy Nasdaq experienced a sharp 2.2% decline over two days, driven by renewed fears about overexposure to AI. The sell-off was about weak earnings and the skepticism regarding the sustainability of tech megacaps’ valuations.Reuters

My Hedge Activity & Results

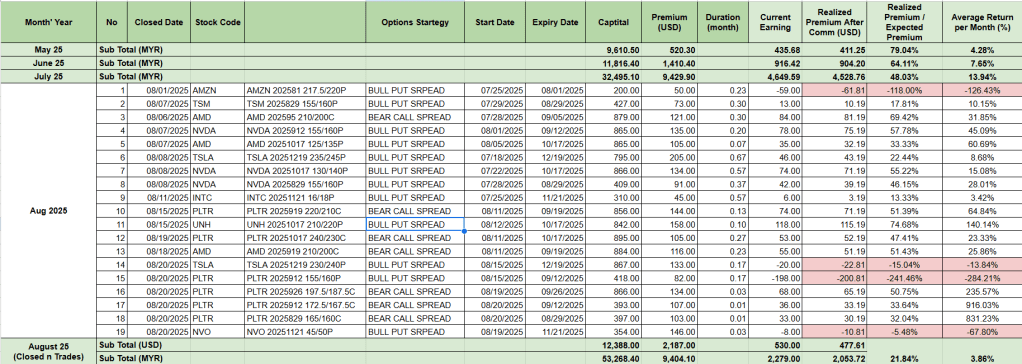

- On August 20, 2025, in response to a cut-loss contract closure, I initiated additional trades to further reduce downside exposure.

- Noticed the realisation of the premium increased fast during the quick drop of the underlying share. I close 3 sell call on the same day.

- A quick summary on trades closed till the 3rd week of Aug’25:

19 trades closed till 3rd week of August’25

📝 Observations

Losses were contained – despite 2 forced cut-loss exits, overall win rate stayed strong at 84%.

Volatility management was key – sudden market drops forced earlier exits and additional hedging.

Short-duration spreads (some less than 5 days) worked well for quick profits (e.g., NVDA, PLTR).