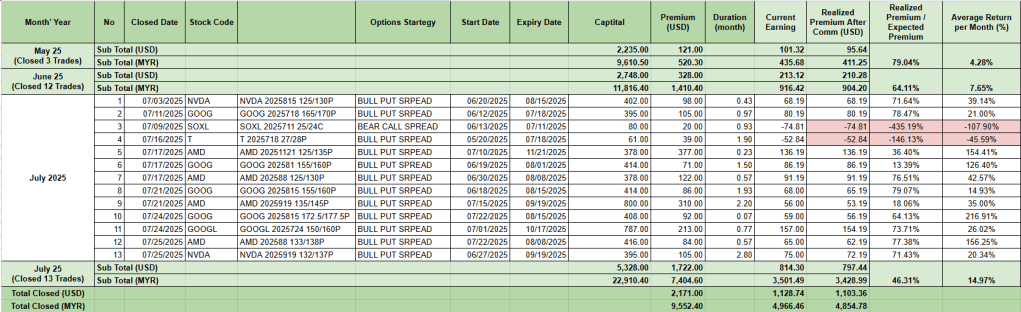

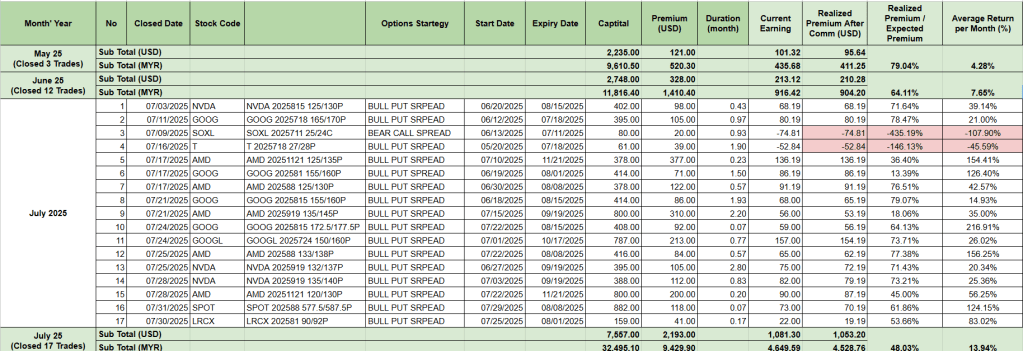

I’VE COMPLETED 32 TRADES SO FAR USING A MIX OF BASIC OPTIONS STRATEGIES

- Sell Put – to collect premium with the intention to buy at a lower price

- Bull Put Spread – a more defined-risk strategy for bullish-to-neutral market

- Bear Call Spread – a more defined-risk strategy for bearish-to-neutral market

A quick summary on trades closed from May’25 till now:

Slowly scaled up the capital allocation for this strategy.

Over the past few months, I’ve been experimenting with the Bull Put Spread options strategy I learned from a paid course. To manage risk while building confidence, I started by allocating only a small percentage of my portfolio to test the strategy in real market conditions. As I became more familiar with the setup, execution, and outcomes, I gradually increased the capital used—aiming for better returns while still keeping risk in check.

OUTCOME:

So far, I’m maintaining ~90 % win rate on my closed trades so far. My focus remains on discipline, consistency and risk management.

I’m still logging each trade and refining the criteria of selecting options for trading. If the win rate stays consistent, I’ll share the full rules, filters, and exit strategy. For now, I’m still adding criteria to fine-tune the setup.

The next results will be updated in a month later to give myself more time to focus on completing my course while continuing to trade.