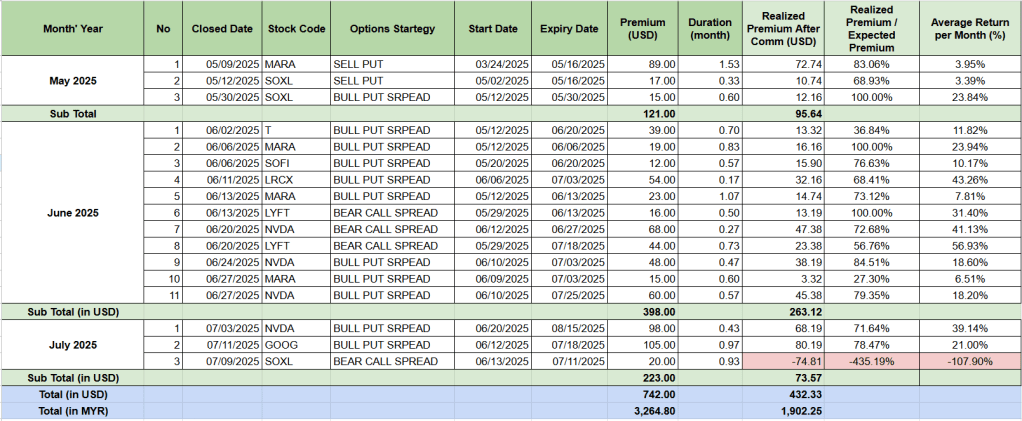

I’ve completed 17 trades SO FAR using a mix of basic options strategies

- Sell Put – to collect premium with the intention to buy at a lower price

- Bull Put Spread – a more defined-risk strategy for bullish-to-neutral market

- Bear Call Spread – a more defined-risk strategy for bearish-to-neutral market

A quick summary on trades closed from May’25 till now:

🎯 My goal isn’t to “hold until expiry” — it’s to manage risk and secure consistent profit where possible

Please refer back to my post earlier for the reason why I closed the trades before expiry.

💰 Outcome (Made 1st Loss):

So far, I’m maintaining a 94.12 % win rate on my closed trades so far. My focus remains on discipline, consistency and risk management.

This week, I recorded my first official loss in my options journey — a bear call spread on SOXL. it is the Direxion Daily Semiconductor Bull 3X Shares ETF.

It aims to deliver 3 times the daily performance of the Semiconductor Sector Index. I placed this trade expecting SOXL to stay below my short strike, based on what I thought was a clear resistance level and overbought signals. However, I didn’t expect momentum strength in a leveraged ETF like SOXL.

Going forward, I’ll focus on more stable underlyings instead of high-volatility, leveraged ETFs like SOXL — especially those with 3x daily movement that can quickly flip a trade against us.

For now, I’m continuing to log each trade and refine my system quietly behind the scenes. As promised earlier, if this win rate continues to hold over the next few months, I’ll share a detailed breakdown of the exact rules, trade filters, and exit strategies I’m using. For now, I am still adding criteria to refine the filters.

Starting now, the results will be updated monthly to give me more time to focus on completing my course while continuing to trade.