Closing another 2 Options contracts before expiry:

Trade #10: NVDA– BEAR CALL SPREAD (Closed in one week instead of two after realizing >72% of the expected profit)

- Trade Placed: June 12, 2025

- Original Expiry: June 27, 2025

- Number of Contact: 1

- Leg 1 – Buy Call

- Strike Price: $157.50

- Premium Paid: $0.56 * 100 = $56 per contract

- Leg 2 – Sell Call

- Strike Price: $152.50

- Premium Received: $1.24 * 100 = $124 per contract

- Total Commission: $2.81

- Net Premium Received: ($124– $56) – $2.81 = $65.19 (on expiry)

I closed it earlier by selling and buying back the BUY PUT and SELL PUT respectively

- Closed Early: June 20, 2025

- Leg 1 – Buy Call

- Sell the call bought at $0.08 option price by receiving $8

- Leg 2 – Sell Call

- Buy back the sold call at $0.23 option price by paying $23

- Total Commission: $2.81

- Net Premium Paid: ($8 – $23) – $2.81 = -$17.81

Hence, instead of earning the full $36.16 on expiry, I took a small gain by paying back $22.84 to close the option contract. The net gain is $65.19 – $17.81= $47.38

Trade #11: LYFT– BEAR CALL SPREAD (Closed in one week instead of two after realizing >72% of the expected profit)

- Trade Placed: May 29, 2025

- Original Expiry: July 28, 2025

- Number of Contact: 1

- Leg 1 – Buy Call

- Strike Price: $17

- Premium Paid: $0.84 * 100 = $84 per contract

- Leg 2 – Sell Call

- Strike Price: $16

- Premium Received: $1.28 * 100 = $128 per contract

- Total Commission: $2.81

- Net Premium Received: ($128– $84) – $2.81 = $41.19 (on expiry)

I closed it earlier by selling and buying back the BUY PUT and SELL PUT respectively

- Closed Early: June 20, 2025

- Leg 1 – Buy Call

- Sell at $0.11 option price by receiving $11

- Leg 2 – Sell Call

- Buy at $0.26 option price by paying $26

- Total Commission: $2.81

- Net Premium Paid: ($11 – $26) – $2.81 = -$17.81

Hence, instead of earning the full $36.16 on expiry, I took a small gain by paying back $22.84 to close the option contract. The net gain is $41.19 – $17.81= $23.38

📊 Summary of Closed Trades (So Far – #1 – 11)

So far, I’ve completed 11 trades using a mix of basic options strategies. Here’s a quick summary of what I’ve tested:

✅ Strategies Used:

- Sell Put – to collect premium with the intention to buy at a lower price

- Bull Put Spread – a more defined-risk strategy for bullish-to-neutral market

- Bear Call Spread – a more defined-risk strategy for bearish-to-neutral market

💰 Outcome (100% Win rate so far):

All trades closed with small but positive profits, which is encouraging. While the gains aren’t huge, that’s completely fine.

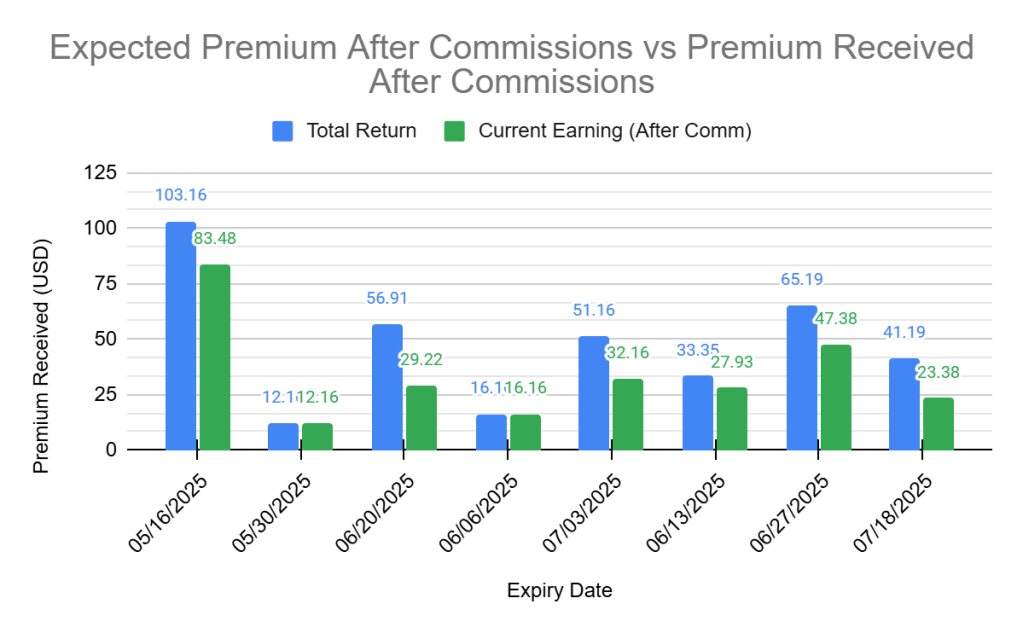

Referring to the Staggered Expiry Dates mentioned in my earlier post [My New Options Routine: Targeting $100/Week with Weekly Expiries]. I buy contracts at different expiry to ensure there are weekly closures to generate some small income.

The table above shows the expected premium received (blue bar) on Staggered Expiry Dates vs the actual premium received (green bar). If the green bar shows lower return than the blue bar, it means one or more contracts for that expected expiry date had been closed earlier. If the contract is expired with profits, both the bars will show same profit return.

Note: Future expiry date shown in the chart means the contract has been closed as of now before its expiry.