Before diving into the full summary, let’s have the quick update on Trade #7.

Trade #7: LRCX – BULL PUT SPREAD (Closed early in 5 days instead of 21 days after realizing more than 68% of the expected Profit)

- Strategy: Bull Put Spread

- Trade Placed: June 6, 2025

- Original Expiry: July 3, 2025

- Number of Contact: 1

- Leg 1 – Buy Put

- Strike Price: $74

- Premium Paid: $35 per contract

- Leg 2 – Sell Put

- Strike Price: $79

- Premium Received: $89 per contract

- Total Commission: $3.25

- Net Premium Received: ($89 – $35) – $2.84 = $51.16 (on expiry)

I closed it earlier by selling and buying back the BUY PUT and SELL PUT respectively

- Closed Early: June 11, 2025

- Leg 1 – Buy Put

- Sell at $0.16 option price by receiving $16

- Leg 2 – Sell Put

- Buy at $0.35 option price by paying $35

- Total Commission: $2.84

- Net Premium Paid: ($16 – $35) – $2.85 = -$21.84

Hence, instead of earning the full $36.16 on expiry, I took a small gain by paying back $22.84 to close the option contract. The net gain is $51.16 – $21.84= $29.32

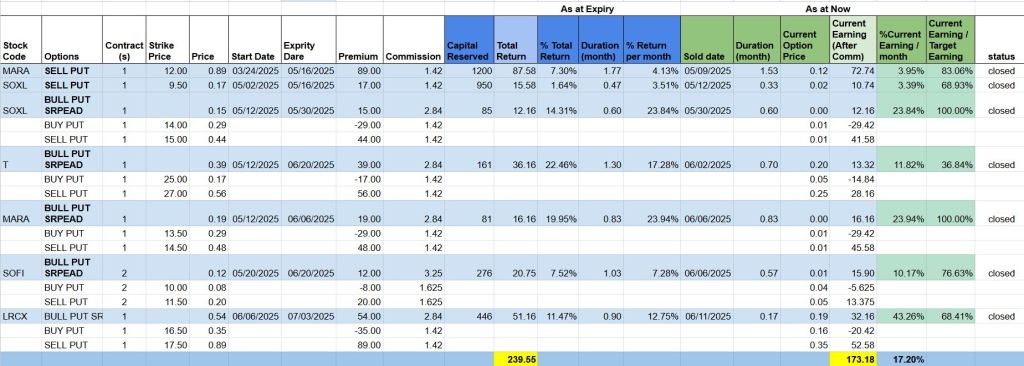

📊 Summary of Closed Trades (So Far – #1 – 7)

So far, I’ve completed 7 trades using a mix of basic options strategies. Here’s a quick summary of what I’ve tested:

✅ Strategies Used:

- Sell Put – to collect premium with the intention to buy at a lower price

- Bull Put Spread – a more defined-risk strategy for bullish-to-neutral market

💰 Outcome:

All trades closed with small but positive profits, which is encouraging. While the gains aren’t huge, that’s completely fine — I treat this as a learning and experimentation phase, not a race to big profits.

The goal is to understand how different strategies behave, how the market responds, and how to manage risk — before scaling up.

The second last column indicates the percentage of my expected target. (Note: If I am very confident that the price will stay below my strike till expiry, i will wait till its expiry. And for some, I will just close as long as some profit is made)

I