📈 What Is a Call Option?

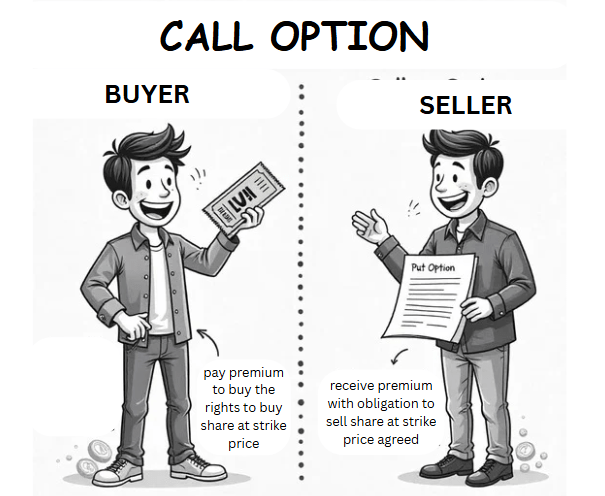

From the buyer point of view:

A Call Option is like a ticket that gives you the right to buy a stock at a certain price (called the strike price) before a specific date.

You pay a small fee upfront (called a premium) to get this right. You don’t have to buy the stock — it’s your choice.

When there is a buyer, there must be a seller. From the seller point of view:

A Call Option seller (also called the option writer) is like someone offering a deal — they agree to sell a stock at a fixed price (strike price) if the buyer decides to use their option.

In return for taking on this obligation, the seller gets paid a small fee upfront, called a premium. This premium is the seller’s immediate income — and also their maximum profit from the contract.

But there’s a RISK:

If the stock price goes way above the strike price, the buyer might exercise the option, to buy 100 shares from the seller at the lower strike price agreed earlier. The seller must then sell the stock at the strike price — facing a loss if they don’t already own the shares, they need to buy the 100 shares from the market based on the market price and sell it to the buyer at the lower strike price agreed earlier.

In short, the seller earns limited reward (premium) but takes on higher risk if the trade moves against them.

DON’T EVER SELL NAKED CALL OPTIONS!!!

“Naked” means you’re selling the option without holding the shares or cash to cover it.

However, you can still earn from a SELL CALL if you have pre-owned the 100 shares since long time ago that were bought at a price lower than a strike price.

📦 One Option = 100 Shares

Remember!!! When you enter one Option contract, it represents 100 shares of a stock. So if the premium is $2, the real cost of the contract is $2 × 100 = $200.

🎟 Simple Example

Let’s say:

- You think a stock will go up – when you buy a call option, it means you are bullish about a stock.

- The current price is $50, you can buy a call option that lets you buy the stock at $50 in the future if the stock price goes up (before the contract expiry date).

- You pay a $2 premium x 100 = $200 for this rights.

Now two things can happen, the stock price can go up or down:

📈 Stock goes up to $60

Buyer will execute the option to buy at $50, then sell at $60

Profit: ($10 – $2 premium) x 100 shares = $8 x 100 = $800

Seller will sell 100 shares at $50 to the buyer

Loss: ($50-$60+$2 premium) x 100 shares = -$8 x 100 = -$800

📉 Stock stays below $50

Buyer will not execute the option

Loss: $2 premium x 100 = $200 premium paid earlier

Seller no need to sell share to the buyer

Profit: $200 premium paid earlier received from the buyer earlier

💡 Why Use Call Options?

You don’t need to invest in 100 shares right away — the option lets you wait and see. If the price goes down, your only loss is the premium you paid, and you’re not required to buy the shares.

In the next post, I’ll explain the other type of option — the Put Option, which is about the right to sell instead of buy.